We have long believed that human emotion and behavioral tendencies move stock prices in the short-term. These price moves are often reactions to events that have limited impact on long-term intrinsic value—this inefficiency creates opportunity. To take advantage of these opportunities, we empower an experienced research team to employ a disciplined, long-term focused approach. In small cap markets, these opportunities can be even more pervasive because the opportunity set is larger and research coverage is smaller.

More than 18 years ago, Hotchkis & Wiley launched its US Small Cap Diversified Value strategy. The strategy takes a distinct approach to evaluating a large universe, by prioritizing stocks for research and conducting efficient analyst reviews. One of the primary objectives was to do the opposite of most active small cap managers: focus disproportionately on the smaller end of the small cap market. Most small cap peers have little presence in this part of the market because trading can be a challenge. Our solution to this was simple: create a highly diversified portfolio with small maximum and average position sizes. We believed we could add value disproportionately in this subsegment of the market because it is inefficient—less research coverage in this part of the market leads to more mispriced opportunities.

This is not to say that all overlooked investments are good ones. In fact, there are many risky and/or overvalued stocks in inefficient segments of the market. In our opinion, a passive approach in this part of the market would lead to owning a lot of weak and risky businesses. Research depth and a disciplined framework are required to distinguish mispriced opportunities from risky/overvalued prospects—traits that are hallmarks of Hotchkis & Wiley.

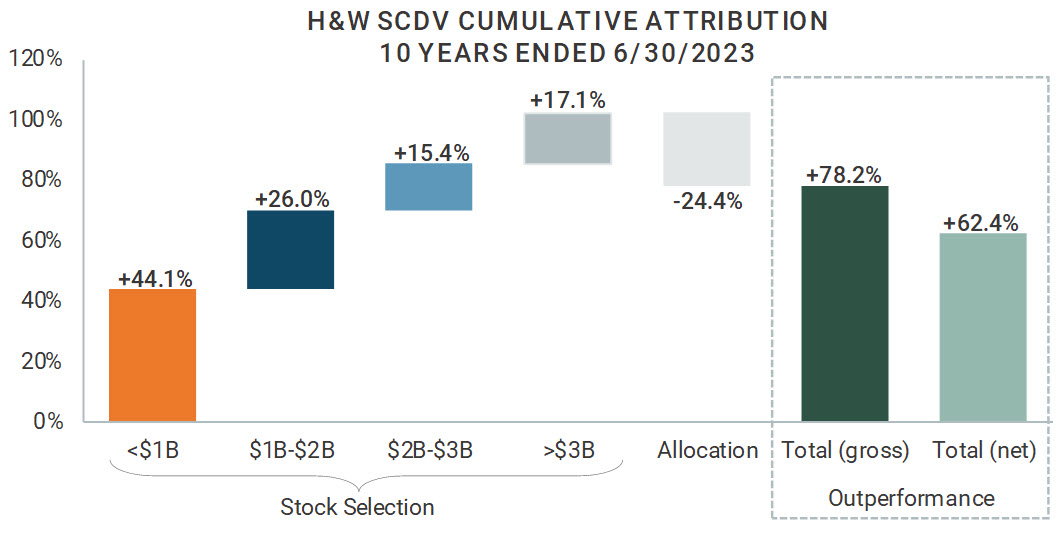

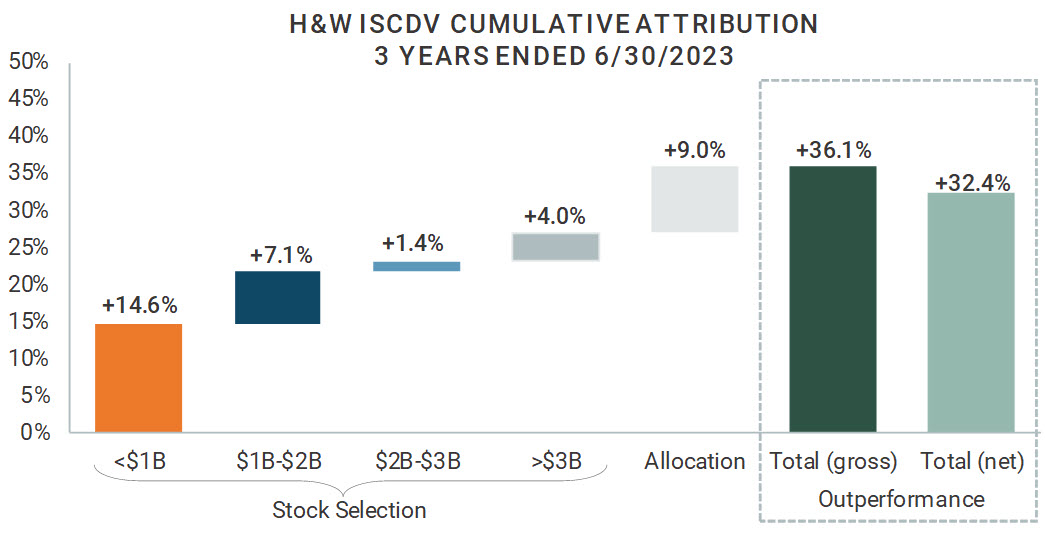

Fortunately, performance has transpired as designed in the US Small Cap Diversified Value strategy, as shown in the chart below. The strategy has outperformed, with a disproportionate amount of the outperformance coming from positive stock selection in stocks with a market cap of less than $1 billion.

About 5 years ago, we began to explore an international small cap strategy that would be managed in a similar fashion. We have been managing global strategies for more than a dozen years and have been conducting research in international markets considerably longer than that. We found that the small cap opportunity set in non-US markets shared some of the same important characteristics as the US, most notably vast breadth and lack of research coverage. We believed that we could take advantage of this like we have in the US strategy, leveraging our deep global value research platform and disciplined investment process. We officially launched the strategy on June 30, 2020, and results from the first three years have been promising.

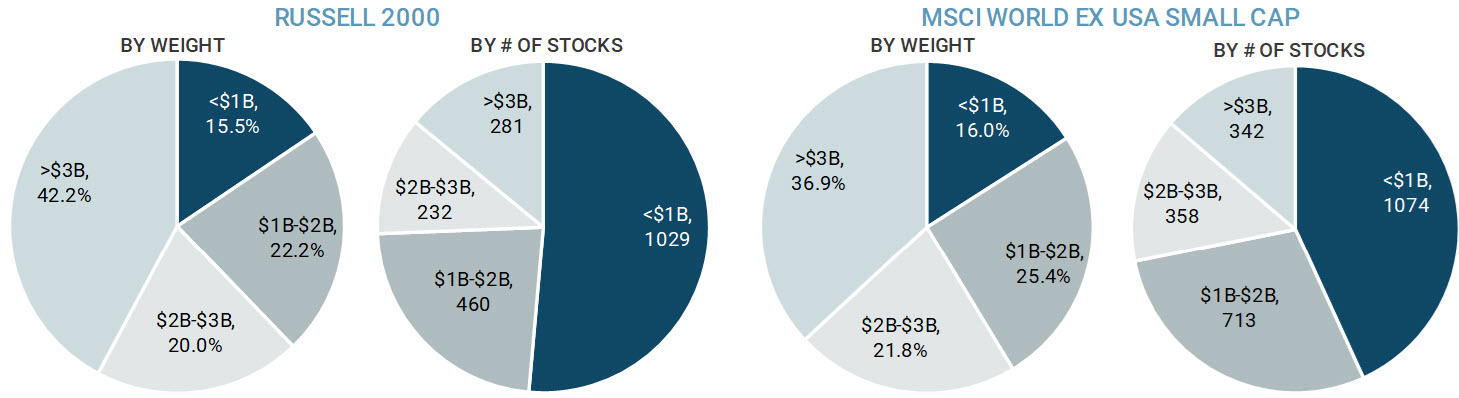

The following chart shows the US small cap index compared to the non-US small cap index. By weight, i.e., market cap, about 40% of both indexes are in stocks with a market cap of more than $3 billion (USD), and only about 15-16% are in stocks with a market cap of less than $1 billion. By number of stocks, however, those under $1 billion in market cap represent a much larger share of the index. Both indexes have more than 1,000 stocks in the sub $1 billion range, or close to half of all securities in the index. These are broad opportunity sets that are likely to contain numerous overlooked ideas. If we were to include non-benchmark names, which we do in our investment process, the number of potential ideas in this cohort would be even larger.

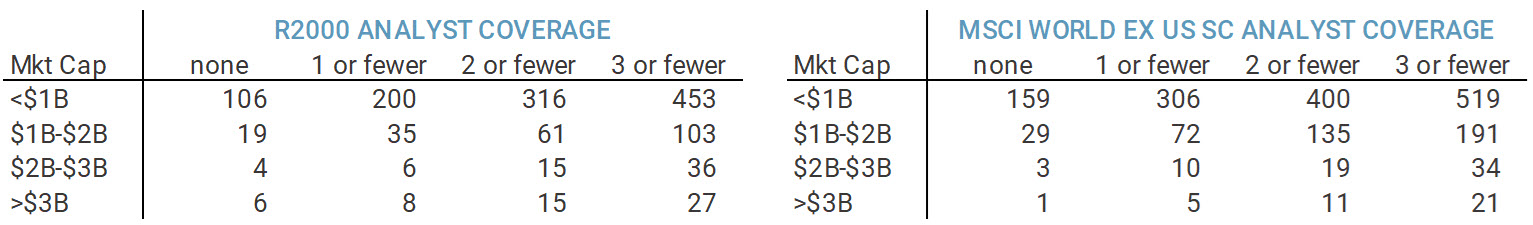

We believed our deep research platform and disciplined investment process could add disproportionate value in the smaller subsegments of the small cap market due to its inefficiency. The tables below show a sell-side coverage summary for the US small cap index compared to the non-US small cap index. It establishes that the level of research coverage becomes less and less the smaller the stocks get, and this is even more prevalent in international markets. We believe these numbers understate the true coverage differences, because it is common that the most junior sell-side analysts start with coverage of smaller stocks while experienced analysts more often cover larger caps. This creates an opportunity for a diversified strategy with an experienced research team and a structured process.

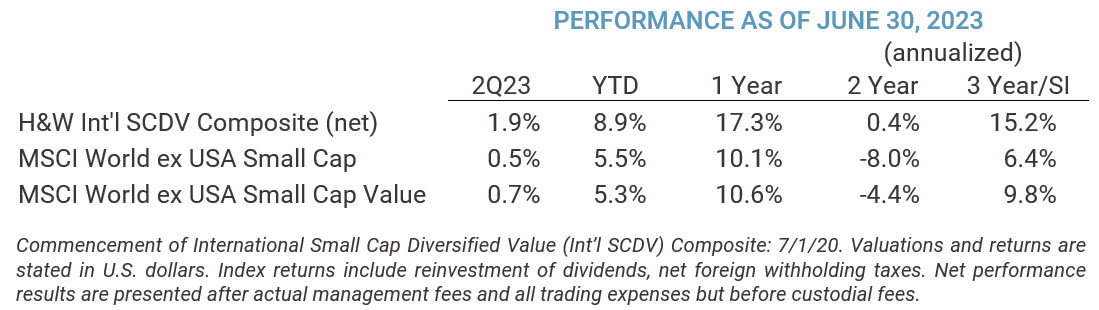

The table below shows the performance of the International Small Cap Diversified strategy relative to the broad and style benchmarks, respectively, over its three-year history.

Like its US counterpart, the strategy has outperformed meaningfully, with the largest source of outperformance being positive stock selection in stocks with a market cap of less than $1 billion.

Small cap equity markets are inefficient due to a general lack of coverage from both buy-side and sell-side researchers. Within small cap markets, the inefficiencies become even more extensive in the smallest subsegments. Our 3-year-old International Small Cap Diversified Value strategy leverages the same deep research platform and same structured approach as our more seasoned US version to exploit these inefficiencies. While the international strategy is nuanced to address differences in corporate governance, accounting, and political risks across geographies, the underlying core competencies are the same. Like the US version, our international small cap strategy was designed to take advantage of an inefficient opportunity set in a systematic fashion—an advantage that we believe should persist for the foreseeable future.