In efficient capital markets, struggling companies often sell at low valuation multiples while leading companies—whose technology is critical for the modern economy—often sell at high valuation multiples. The future is the enemy of struggling businesses and current results are most of the value these businesses are ever likely to create. Time is an ally of a strong business, which will grow and persist through time: current results are a small part of the value intrinsic to these businesses.

There is often a vibrant controversy about which side of this divide a business falls on. The future direction of some businesses is obvious, but there is uncertainty about how the fortunes of most businesses will change over time. It is rare to have a company where there is widespread agreement that the future is on its side, but it happens. It happens when a company leads an industry essential to modern life, where increasingly sophisticated technology is enriching its value-add while growing its barriers to entry, and where a key competitor may face problems serious enough to threaten their relevance. Efficient capital markets would not value this type of business as if it had a dim future.

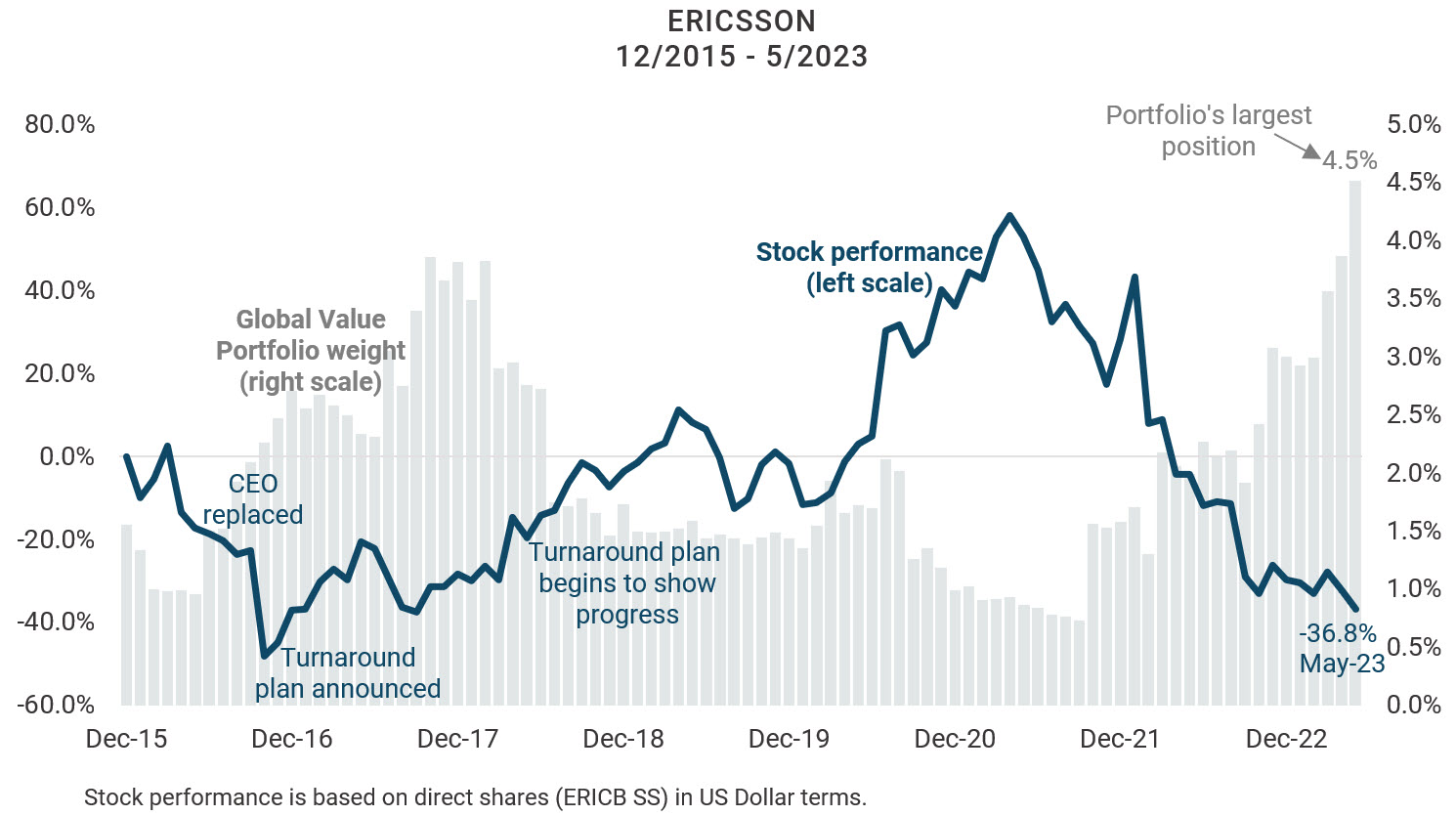

Yet this is exactly the situation we believe Ericsson is facing today. In spite of what appears to be a strong future, the company is valued as if the future is bleak. It seems like Ericsson is being left for dead.

What does being left for dead look like? Ericsson’s reasonable guidance is for margins to improve to 15% in 2024 as they reach their medium-term levels of 15-18%. Management expects margins to “grow from there”: that 15-18% guidance includes a few businesses whose margins are low, or even negative, as Ericsson fixes some businesses and invests in areas of growth. At 15% margins, Ericsson’s PE is about 6x. At 18% margins, Ericsson’s PE is about 5x. Ericsson is not a fast-growing company, but to us, this appears to be a case of a market-leading company with a net cash balance sheet, trading at a PE that is about equal to its growth rate. Even with slow growth, at something near 5-times earnings, the company’s total return is well over 20%.

Ericsson was not always this overlooked. Ericsson ended 2006 with a $65B market capitalization. At that time, its key market for mobile telecom equipment was fragmented and faced disruption from Chinese vendors with leading products and aggressive pricing. That shock drove consolidation that 17 years later leaves effectively a three-player market. In spite of this significant improvement in industry structure, Ericsson’s market capitalization is now only $17B.

Ericsson is the leader in this three-player market with near 40% share. The close second in this market is Huawei with ~35% share. We believe it may grow harder and harder for Huawei to maintain that share. Huawei has outstanding engineering and a large captive domestic Chinese market, but faces problems as politics bleeds into commerce. Huawei is banned from many markets and the list of banned markets may grow. Sanctions block Huawei from obtaining cutting-edge components needed to compete. Huawei has navigated these challenges well so far, but these problems may become more significant over time and Huawei’s problems are opportunities for Ericsson.

Like all companies, Ericsson has problems and bearish analysts are quick to highlight these problems. First and foremost is that the current margin of ~10% is below the company’s 15-18% guidance. While there seems to be consensus that 2023 results are temporarily weak on mix-shift, customer inventory destocking, and Ericsson’s investments in growth areas, there is vibrant controversy about how much margins will improve. Many on Wall Street play the game of guessing about whether the company will reach their 15% goal by 2024, and some are bearish because they doubt the company will reach that goal by that deadline. We believe this is a false controversy: missing a short-term margin goal by an immaterial magnitude does not matter. The noise around this false controversy seems to be creating an opportunity to create value for clients.

We create value by finding misunderstood opportunities and mispriced risk. Ericsson’s misunderstood opportunity is 5G: at the end of 2022, 5G only covered 20% of the population in Ericsson’s markets.1 The mispriced risks surround margin, regulation, technology, and capital allocation:

- The uncertainty over Ericsson’s ability to meet its 2024 margin target overshadows the far more important question of what margins look like as Ericsson’s business evolves. Reaching 15% margins eventually is far more important than the timing of when it reaches this level. Intrinsic value changes significantly if the company never reaches a 15% margin, but even at a 12% margin the stock trades at less than 7.5x earnings, still a very attractive valuation.

- Over the past few years Ericsson has paid over $1B in fines for violating the Foreign Corrupt Practices Act prior to 2016. Part of Ericsson’s turn-around since replacing management in 2016 has been a new focus on compliance: while additional fines are possible, we see this risk falling over time.

- There is a new technology called ORAN that some skeptics worry may commoditize certain market segments. Many believe this controversy is fading over time as the early adopters of ORAN seem to be failing, but new technology is always a risk for all technology companies. We are paying close attention to this.

- Capital allocation used to be as simple as the large dividend, but Ericsson undertook uncharacteristically large M&A when it bought Vonage a year ago. We believe management that this was the largest deal they are likely to do, especially now that there is an activist on the Board.

Ericsson presents an anomaly: usually a business at this valuation faces serious issues and a highly uncertain future. Ericsson has some challenges but nothing like its stock price implies. Efficient Market Hypothesis implies that such anomalies cannot exist, but that framework misses how vast and diverse capital markets can be. Markets are often reasonably efficient, but not always. Sometimes capital market prices are wrong and market-leading businesses are left for dead. Ericsson’s price implies a bleak future, but we see a compelling opportunity.